Infrencia’s management team boasts a wealth of experience in asset raising covering numerous projects closed over the past 15 years. Selective highlights of some of these examples, both ongoing, closed and under consideration in the infrastructure space are presented below. Our team have had extensive experience in asset raising across a number of infrastructure platforms, including sustainable, renewable and green version and at both greenfield and brownfield phases.

PROJECTS UNDER CONSIDERATION

Decarbonization

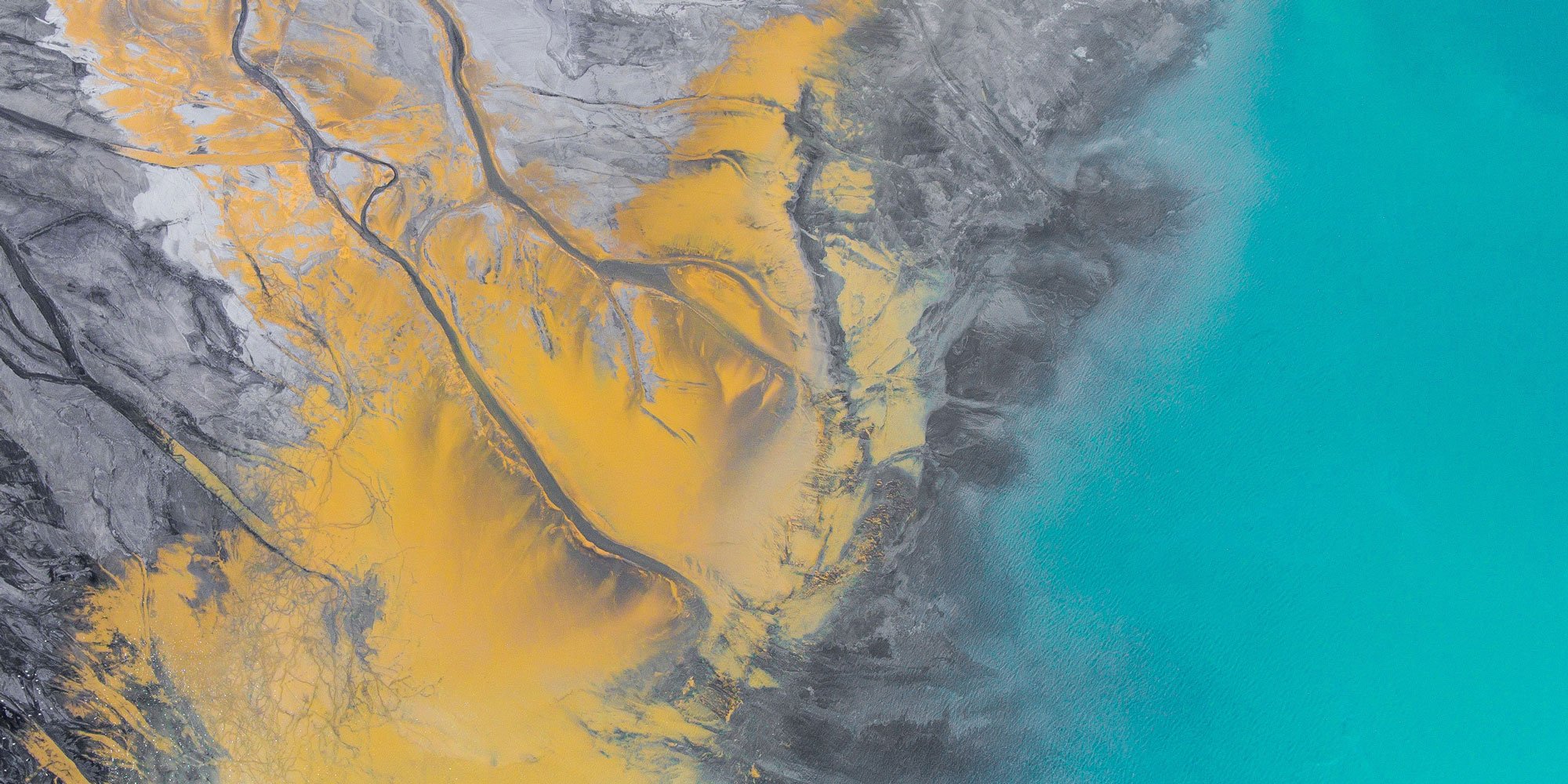

A project to power cobalt mines in Latin America with renewable power including development of carbon storage facilities.

Carbon Sequestration on Farmland

Reduction of climate change through the utilization of innovative measurement techniques to refine carbon sequestration on farmland, widen voluntary carbon markets and facilitate environmentally safe farming methods.

Smart Cities

Vizag 1 (also known as Vishakapatnam) Project, Andra Pradesh, India, partnering with an Asian private investment partner.

Project cost: $5bn USD

Scope of the Project: To create a new capital city (Vizag).

Estimated Asset Raise: $200m (initial phase)

Project Listing: transportation networks, rail and metro systems, airports, ports, highways, provide lighting materials for the entire city (toll roads, highways, bridges) with the most energy-efficient lighting materials without planned obsolescence, highest durability, and repairable for 1/3 the cost of replacement.

Additional responsibilities: provide prefabricated smart homes (industrial production) with digital sensors and solar panels through Infrencia’s partner company, attract large global 5-star hotel chains, and innovative environmentally focused architectural design to be integrated into the urban and coastal landscape in Vizag.

Mini-Hydro Power Plants

A pipeline of run-of-river hydropower plants across a number of rivers (Asia). The hydropower plant uses low head and run-of-river schemes for power generation which is more friendly to the environment, not requiring a big catchment area and hence poses no flooding risk. The water flows through the intake of the river. This kind of project poses min. changes of the environment

Total Fund Size: $50m

Closed: tbd

LPS: tbd

PROJECTS INITIATED

Renewable Power (ongoing)

A diversified platform of power projects over sub-Saharan African across mature technologies including solar PV, wind, geothermal, small to medium hydro (run-of river) and biomass. The Fund takes an opportunistic approach to project development, prioritising underserved markets with a clear timeline to financial close. The Fund provides primarily ordinary equity for the development and construction of several greenfield renewable energy projects in Sub-Saharan Africa. The fund scope encompasses both grid-connected as well as decentralized energy projects (commercial & industrial solar, mini-grids and solar home systems companies.

Total Fund Size: $250m

Closed: $175m

LPS: European/EMEA pension funds; DFIs

Asian Renewable Power Fund

Renewable power across islands in Asia providing power for generation and connectivity

Total Fund Size: $250m

Progress to Close: $50m

Tenure: 5 to 7 years

Limited Partners: State Owned Enterprises; Pension and Super Funds; Endowments

Transport Infrastructure

Major toll roads connecting key routes across Asia.

Total Fund Size: $750m - $1 bln

Progress to Close: $150m

Tenure: 15 years

Limited Partners: State Owned Enterprises; DFIs, Public Pension Plans

PROJECTS CLOSED

Sustainable Infrastructure

Asian pooled asset platform across water desalination dam, Mumbai airport hospital, inter-Asia highways incl toll roads; The fund currently holds approximately $750 million in Indian assets across investments spanning the toll road, thermal power, renewable energy, and social infrastructure sub-sectors.

Closed: $750m

Tenure: 10 years

Limited Partners: US corporate and public pension funds; global super funds, endowments; sovereign wealth funds

Global Farmland

A diversified platform investing in dairy, livestock and agriculture in Australasia, Europe.

Total Fund Size: $230m

Closed: $230m

Tenure: 10 years

Limited Partners: European pension funds; public funds, endowments; sovereign wealth funds